For the 2025 MLB season, the ability to watch in-market games will include more streaming opportunites along with the traditonal regional sports network.

4 Mar, 2025 | Admin | No Comments

Zelensky’s Fox Interview After Oval Office Drama Draws 6 Million Viewers

Bret Baier’s interview with Zelensky was the most-watched show in cable and broadcast television Friday night.

4 Mar, 2025 | Admin | No Comments

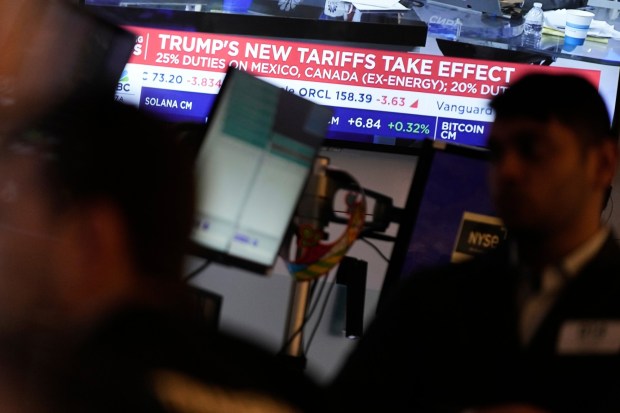

Wall Street falls again as losses wipe out all post-election gains for the S&P 500

By DAMIAN J. TROISE and ALEX VEIGA, AP Business Writers

Stocks racked up more losses on Wall Street Tuesday as a trade war between the U.S. and its key trading partners escalated, wiping out all the gains since Election Day for the S&P 500.

The Trump administration imposed tariffs on imports from Canada and Mexico starting Tuesday and doubled tariffs against imports from China. All three countries announced retaliatory actions, sparking worries about a slowdown in the global economy.

The S&P 500 fell 1.2%, with more than 80% of the stocks in the benchmark index closing lower. The Dow Jones Industrial Average slid 1.6%.

The Nasdaq composite slipped 0.4%. The tech-heavy index briefly reached a 10% decline from its most recent closing high, which is what the market considers a correction, but gains for Nvidia, Microsoft and other tech heavyweights helped pare those losses.

Financial stocks were among the heaviest weights on the S&P 500 index. JPMorgan Chase fell 4% and Bank of America lost 6.3%.

Markets in Europe fell sharply, with Germany’s DAX falling 3.5% as automakers saw sharp losses. Stocks in Asia saw more modest declines.

“The markets are having a tough time even setting expectations for what this trade war could look like,” said Ross Mayfield, investment strategy analyst at Baird. “This is clearly a level step higher than anything we saw during (Trump’s) first term.”

The market could soon face more twists in the tariff drama. President Donald Trump addresses a joint session of Congress Tuesday night. After the closing bell, Commerce Secretary Howard Lutnick told Fox Business News that the U.S. would likely meet Canada and Mexico “in the middle” on tariffs, with an announcement coming as soon as Wednesday.

The recent decline in U.S. stocks has wiped out all of the markets’ gains since Trump’s election in November. That rally had been built largely on hopes for policies that would strengthen the U.S. economy and businesses. Worries about tariffs raising consumer prices and reigniting inflation have been weighing on both the economy and Wall Street.

The tariffs are prompting warnings from retailers, including Target and Best Buy, as they report their latest financial results. Target fell 3% despite beating Wall Street’s earnings forecasts, saying there will be “meaningful pressure” on its profits to start the year because of tariffs and other costs.

Best Buy plunged 13.3% for the biggest drop among S&P 500 stocks after giving investors a weaker-than-expected earnings forecast and warning about tariff impacts.

“International trade is critically important to our business and industry,” said Best Buy CEO Corie Barry.

Barry said China and Mexico are the top two sources for products that Best Buy sells, and it also expects vendors to pass along tariff costs, which would make price increases for American consumers likely.

Imports from Canada and Mexico are now to be taxed at 25%, with Canadian energy products subject to 10% import duties. The 10% tariff that Trump placed on Chinese imports in February was doubled to 20%.

Retaliations were swift.

China responded to new U.S. tariffs by announcing it will impose additional tariffs of up to 15% on imports of key U.S. farm products, including chicken, pork, soy and beef, and expanded controls on doing business with key U.S. companies. Canada plans on slapping tariffs on more than $100 billion of American goods over the course of 21 days. Mexico also plans tariffs on goods imported from the U.S.

Companies in the S&P 500 are wrapping up the latest round of quarterly financial reports. They’ve posted broad earnings growth of 18% for the fourth quarter. But Wall Street has already trimmed expectations for the current quarter to about 7% growth from just over forecasts of 11% at the beginning of the year.

“The hit to growth is more of the commentary that we’ll be looking for from companies,” said Kevin Gordon, senior investment strategist at Charles Schwab.

Concerns about profits follow a series of economic reports with worrisome signals that include U.S. households becoming more pessimistic about inflation and pulling back on spending. Consumer spending has essentially driven U.S. economic growth in the face of high interest rates.

Wall Street has been hoping that the Federal Reserve would continue lowering interest rates in 2025. The central bank has signaled more caution, though, partly because of uncertainty surrounding the economic impact of tariffs. The Fed is expected to hold rates steady at its upcoming meeting later in March.

The Fed raised interest rates to their highest level in two decades in order to tame inflation. It started cutting its benchmark rate in 2024 as the rate of inflation moved closer to its target of 2%. But inflation remains stubbornly just above that target and tariffs threaten price increases that could fuel inflation.

In the bond market, Treasury yields were mixed. The yield on the 10-year Treasury rose to 4.20% from 4.16% late Monday. It’s still down sharply from last month, when it was approaching 4.80%, as worries have grown about the strength of the U.S. economy.

“Because tariffs are in effect, and there’s no guarantee that they’re likely to be temporary, that’s filtering its way to the bond market and we’re seeing the threat of higher inflation eroding the value of the 10-year note,” said Sam Stovall, chief investment strategist at CFRA.

The yield on the 2-year Treasury held steady at 3.94%.

All told, the S&P 500 fell 71.57 points to 5,778.15. The Dow dropped 670 points to 42,520.99, and the Nasdaq shed 65.03 points to 18,285.16.

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.

By PAUL WISEMAN, Associated Press Economics Writer

WASHINGTON (AP) — Tariffs are in the news at the moment. Here’s what they are and what you need to know about them:

Tariffs are a tax on imports

Tariffs are typically charged as a percentage of the price a buyer pays a foreign seller. In the United States, tariffs are collected by Customs and Border Protection agents at 328 ports of entry across the country.

U.S. tariff rates vary: They are generally 2.5% on passenger cars, for instance, and 6% on golf shoes. Tariffs can be lower for countries with which the United States has trade agreements. Before the U.S. began imposing 25% tariffs on good from Canada and Mexico as of Tuesday, most goods moved between the United States and those countries tariff-free because of President Donald Trump’s U.S.-Mexico-Canada trade agreement.

Mainstream economists are generally skeptical about tariffs, considering them an inefficient way for governments to raise revenue.

There’s much misinformation about who actually pays tariffs

Trump is a proponent of tariffs, insisting that they are paid for by foreign countries. In fact, it is importers — American companies — that pay tariffs, and the money goes to the U.S. Treasury. Those companies typically pass their higher costs on to their customers in the form of higher prices. That’s why economists say consumers usually end up footing the bill for tariffs.

Still, tariffs can hurt foreign countries by making their products pricier and harder to sell abroad. Foreign companies might have to cut prices — and sacrifice profits — to offset the tariffs and try to maintain their market share in the United States. Yang Zhou, an economist at Shanghai’s Fudan University, concluded in a study that Trump’s tariffs on Chinese goods inflicted more than three times as much damage to the Chinese economy as they did to the U.S. economy.

What has Trump said about tariffs?

Trump has said tariffs will create more factory jobs, shrink the federal deficit, lower food prices and allow the government to subsidize childcare.

“Tariffs are the greatest thing ever invented,’’ Trump said at a rally in Flint, Michigan, during his presidential campaign.

During his first term, Trump imposed tariffs with a flourish — targeting imported solar panels, steel, aluminum and pretty much everything from China.

“Tariff Man,” he called himself.

Trump is moving ahead with higher tariffs in his second term.

The United States in recent years has gradually retreated from its post-World War II role of promoting global free trade and lower tariffs. That’s generally a response to the loss of U.S. manufacturing jobs, widely attributed to unfettered tree trade and and China’s ascent as a manufacturing power.

Tariffs are intended mainly to protect domestic industries

By raising the price of imports, tariffs can protect home-grown manufacturers. They may also serve to punish foreign countries for unfair trade practices such as subsidizing their exporters or dumping products at unfairly low prices.

Before the federal income tax was established in 1913, tariffs were a major revenue source for the government. From 1790 to 1860, tariffs accounted for 90% of federal revenue, according to Douglas Irwin, a Dartmouth College economist who has studied the history of trade policy.

Tariffs fell out of favor as global trade grew after World War II. The government needed vastly bigger revenue streams to finance its operations.

In the fiscal year that ended Sept. 30, the government collected around $80 billion in tariffs and fees, a trifle next to the $2.5 trillion that comes from individual income taxes and the $1.7 trillion from Social Security and Medicare taxes.

Still, Trump favors a budget policy that resembles what was in place in the 19th century.

Tariffs can also be used to pressure other countries on issues that may or may not be related to trade. In 2019, for example, Trump used the threat of tariffs as leverage to persuade Mexico to crack down on waves of Central American migrants crossing Mexican territory on their way to the United States.

Trump even sees tariffs as a way to prevent wars.

“I can do it with a phone call,’’ he said at an August rally in North Carolina.

If another country tries to start a war, he said he’d issue a threat:

“We’re going to charge you 100% tariffs. And all of a sudden, the president or prime minister or dictator or whoever the hell is running the country says to me, ‘Sir, we won’t go to war.’ ”

Economists generally consider tariffs self-defeating

Tariffs raise costs for companies and consumers that rely on imports. They’re also likely to provoke retaliation.

The European Union, for example, punched back against Trump’s tariffs on steel and aluminum by taxing U.S. products, from bourbon to Harley-Davidson motorcycles. Likewise, China has responded to Trump’s trade war by slapping tariffs on American goods, including soybeans and pork in a calculated drive to hurt his supporters in farm country.

A study by economists at the Massachusetts Institute of Technology, the University of Zurich, Harvard and the World Bank concluded that Trump’s tariffs failed to restore jobs to the American heartland. The tariffs “neither raised nor lowered U.S. employment’’ where they were supposed to protect jobs, the study found.

Despite Trump’s 2018 taxes on imported steel, for example, the number of jobs at U.S. steel plants barely budged: They remained right around 140,000. By comparison, Walmart alone employs 1.6 million people in the United States.

Worse, the retaliatory taxes imposed by China and other nations on U.S. goods had “negative employment impacts,’’ especially for farmers, the study found. These retaliatory tariffs were only partly offset by billions in government aid that Trump doled out to farmers. The Trump tariffs also damaged companies that relied on targeted imports.

If Trump’s trade war fizzled as policy, though, it succeeded as politics. The study found that support for Trump and Republican congressional candidates rose in areas most exposed to the import tariffs — the industrial Midwest and manufacturing-heavy Southern states like North Carolina and Tennessee.

4 Mar, 2025 | Admin | No Comments

Trump’s trade war draws swift retaliation as Mexico, Canada and China impose tariffs on the US

By JOSH BOAK, PAUL WISEMAN and ROB GILLIES, Associated Press

WASHINGTON (AP) — President Donald Trump launched a trade war Tuesday against America’s three biggest trading partners, drawing immediate retaliation from Mexico, Canada and China and sending financial markets into a tailspin as the U.S. faced the threat of rekindled inflation and paralyzing uncertainty for business.

Just after midnight, Trump imposed 25% taxes, or tariffs, on Mexican and Canadian imports, though he limited the levy to 10% on Canadian energy. Trump also doubled the tariff he slapped last month on Chinese products to 20%.

Beijing retaliated with tariffs of up to 15% on a wide array of U.S. farm exports. It also expanded the number of U.S. companies subject to export controls and other restrictions by about two dozen.

Canadian Prime Minister Justin Trudeau said his country would plaster tariffs on more than $100 billion of American goods over the course of 21 days.

“Today the United States launched a trade war against Canada, their closest partner and ally, their closest friend. At the same, they are talking about working positively with Russia, appeasing Vladimir Putin, a lying, murderous dictator. Make that make sense,” Trudeau said.

Later in the day, Commerce Secretary Howard Lutnick said the U.S. would likely meet Canada and Mexico “in the middle,” with an announcement coming as soon as Wednesday.

Lutnick told Fox Business News that the tariffs would not be paused, but that Trump would reach a compromise.

“I think he’s going to figure out, you do more, and I’ll meet you in the middle in some way,” Lutnick said.

Mexican President Claudia Sheinbaum said Mexico will respond to the new taxes with its own retaliatory tariffs. Sheinbaum said she will announce the products Mexico on Sunday. The delay might indicate that Mexico still hopes to de-escalate Trump’s trade war.

The president is abandoning the free trade policies the United States pursued for decades after World War II. He argues that open trade cost America millions of factory jobs and that tariffs are the path to national prosperity. He rejects the views of mainstream economists who contend that such protectionism is costly and inefficient.

Import taxes are “a very powerful weapon that politicians haven’t used because they were either dishonest, stupid or paid off in some other form,” Trump said Monday. “And now we’re using them.”

Dartmouth College economist Douglas Irwin, author of a 2017 history of U.S. tariff policy, has calculated that Tuesday’s hikes will lift America’s average tariff from 2.4% to 10.5%, the highest level since the 1940s. “We’re in a new era for sure.”

U.S. markets dropped sharply Monday after Trump said there was “no room left” for negotiations that could lower the tariffs. Shares were mostly lower Tuesday after they took effect.

The Yale University Budget Lab estimates that Trump’s tariffs amount to a tax hike of $1.4 trillion to $1.5 trillion over 10 years and would disproportionately hit the poor.

Trump has said tariffs are intended to address drug trafficking and illegal immigration. But he’s also said the tariffs will come down only if the U.S. trade deficit narrows.

The American president has injected a disorienting volatility into the world economy, leaving it off balance as people wonder what he will do next.

During his first term, Trump imposed tariffs only after lengthy investigations — into the national security implications of relying on foreign steel, for example, said Michael House, co-chair of the international trade practice at the Perkins Coie law firm.

But by declaring a national emergency last month involving the flow of immigrants and illicit drugs across U.S. borders, “he can modify these tariffs with a stroke of the pen,’’ House said. “It’s chaotic.”

Democratic lawmakers were quick to criticize the tariffs.

“Donald Trump is not a king,” Rep. Gregory Meeks, top Democrat on the House Foreign Affairs Committee, said. “Presidents don’t get to invent emergencies to justify bad policies. Abusing emergency powers to wage an economic war on our closest allies isn’t leadership — it’s dangerous.”

Even some Republican senators raised alarms. “Maine and Canada’s economy are integrated,” said Sen. Susan Collins, R-Maine, explaining that much of the state’s lobsters and blueberries are processed in Canada and then sent back to the U.S.

Truck driver Carlos Ponce, 58, went about business as usual Tuesday morning, transporting auto parts from Ciudad Juarez, Mexico, to El Paso, Texas, just as he’s done for decades.

Like many on the border, he was worried about the fallout from the tariffs. “Things could change drastically,” Ponce said. Truckers could lose their jobs or have to drive farther to coastal ports as Mexican manufacturers look for trading partners beyond the U.S.

Alan Russell, head of Tecma, which helps factories set up in places like Ciudad Juarez, is skeptical that Trump’s tariffs will bring manufacturing back to the United States.

“Nobody is going to move their factory until they have certainty,” Russell said. Just last week, he said, Tecma helped a North Carolina manufacturer that moved to Mexico because it couldn’t find enough workers in the United States.

U.S. businesses near the Canadian border scrambled to deal with the impact. Gutherie Lumber in suburban Detroit reached out Tuesday to Canadian suppliers about the cost of 8-foot wood studs. About 15% of the lumber at Gutherie yard in Livonia, Michigan, comes from Canada.

Sales manager Mike Mahoney said Canadian suppliers are already raising prices. “They’re putting that 25% on studs.” Builders will strain to stay within their budgets.

Retaliation will likely pinch U.S. businesses.

After years of effort and thousands of dollars in investment, Tom Bard, a Kentucky craft bourbon distiller, gained a foothold in the Canadian provinces of British Columbia and Alberta and watched his sales grow north of the border. Now Kentucky bourbon is in Canada’s crosshairs, and an order from his Canadian distributors is on hold.

“That hurts,” he said. At his small distillery “every single pallet that goes out the door makes a huge difference … The last thing you want is to have an empty spot where your bottles are supposed to be on a shelf.”

Bard co-owns the Bard Distillery with his wife, Kim, in western Kentucky’s Muhlenberg County, about 135 miles (217 kilometers) southwest of Louisville, Kentucky.

Trump overwhelmingly carried Kentucky in the November election. In Muhlenberg County, Trump defeated Kamala Harris by a more than 3-to-1 margin.

The China tariffs threaten the U.S. toy industry. Greg Ahearn, president and CEO of the Toy Association, said the 20% tariffs on Chinese goods will be “crippling,” as nearly 80% of toys sold in the U.S. are made in China.

Steve Rad, CEO of the Austin, Texas-based toy maker Abacus Brands Inc., hopes to find ways to avoid raising prices in the wake of the 20% tax on Chinese goods.

The company will have to “go to war” with its pricing and cost structure and figure out how to avoid penalizing consumers. For one product, a $39.99 kit that teaches children how volcanoes work, he’s thinking of switching to cheaper, lower-quality paper.

Rachel Lutz owns the Peacock Room, four women’s boutique shops with about 15 employees in Detroit. She’s been bracing for the tariffs but doesn’t understand the logic behind them.

“I’m struggling to see the wisdom in picking a fight with our largest trading partner that we’ve had historically wonderful relationships with,” Lutz said Tuesday from her shop. “I’m struggling to really understand how they can’t see that will profoundly impact our economy in ways that I think the American consumer has not predicted. We’re about to find out.”

Gillies reported from Toronto. Associated Press writers Anne D’Innocenzio in New York; Corey Williams in Detroit, Bruce Schreiner in Louisville, Kentucky; Didi Tang and Lisa Mascaro in Washington; and Megan Janetsky and Maria Versa in Mexico City contributed to this report.

4 Mar, 2025 | Admin | No Comments

'Not A Tax': How Sam's Club Is Fixing Retail Media's Trust Problem

As brands grow increasingly skeptical of retail media’s value, Harvey Ma is determined to change the narrative.

4 Mar, 2025 | Admin | No Comments

Updated Oscar Ratings: 5 Year High In Both Total Viewers And Adults 18-49

After three consecutive years of growth, the live 97th Academy Awards slipped to 18.07 million viewers across ABC and Hulu.

Carl Dean, Dolly Parton’s husband of 58 years, died Monday in Nashville. He was 82.

3 Mar, 2025 | Admin | No Comments

Dow drops nearly 650 points on worries that Trump’s latest tariffs will slow the economy more

By STAN CHOE, AP Business Writer

NEW YORK (AP) — U.S. stocks tumbled Monday and wiped out even more of their gains since President Donald Trump ’s election in November, after he said that tariffs announced earlier on Canada and Mexico would take effect within hours.

The S&P 500 dropped 1.8% after Trump said there was “no room left” for negotiations that could lower the tariffs set to begin Tuesday for imports from Canada and Mexico. Trump had already delayed the tariffs once before to allow more time for talks.

Trump’s announcement dashed hopes on Wall Street that he would choose a less painful path for global trade, and it followed the latest warning signal on the U.S. economy’s strength. Monday’s loss shaved the S&P 500’s gain since Election Day down to just over 1% from a peak of more than 6%. That rally had been built largely on hopes for policies from Trump that would strengthen the U.S. economy and businesses.

The Dow Jones Industrial Average dropped 649 points, or 1.5%, and the Nasdaq composite slumped 2.6%.

Monday’s slide punctuated a rocky couple of weeks for Wall Street. After the S&P 500 set a record last month following a parade of fatter-than-expected profit reports from big U.S. companies, the market began diving following weaker-than-expected reports on the U.S. economy, including a couple showing U.S. households are getting much more pessimistic about inflation because of the threat of tariffs.

The latest such report arrived Monday on U.S. manufacturing. Overall activity is still growing, but not by quite as much as economists had forecast. Perhaps more discouragingly, manufacturers are seeing a contraction in new orders. Prices, meanwhile, rose amid discussions about who will pay for Trump’s tariffs.

“Demand eased, production stabilized, and destaffing continued as panelists’ companies experience the first operational shock of the new administration’s tariff policy,” said Timothy Fiore, chair of the Institute for Supply Management’s manufacturing business survey committee.

The hope on Wall Street had been that Trump was using the threat of tariffs as a tool for negotiations and that he would ultimately go through with potentially less damaging policies for the global economy and trade. But Trump’s going forward with the Mexican and Canadian tariffs hit a market that wasn’t certain about what would happen next.

The market’s recent slump has hit Nvidia and some other formerly high-flying areas of the market particularly hard. They fell even more Monday, with Nvidia down 8.8% and Elon Musk’s Tesla down 2.8%.

Elsewhere on Wall Street, Kroger fell 3% after the grocery chain’s Chairman and CEO Rodney McMullen resigned following an internal investigation into his personal conduct.

Wall Street’s blue Monday even pulled down stocks of companies enmeshed in the cryptocurrency economy, which had risen strongly in the morning. They initially bounced after Trump said over the weekend that his administration was moving forward with a crypto strategic reserve.

But MicroStrategy, the company that’s now known as Strategy and has been raising money to buy bitcoin, slid to a loss of 1.8%. Coinbase, the crypto trading platform, fell 4.6%.

All told, the S&P 500 fell 104.78 points to 5,849.72. The Dow Jones Industrial Average dropped 649.67 to 43,191.24, and the Nasdaq composite slumped 497.09 to 18,350.19.

Across the Pacific in China, manufacturers reported an uptick in orders in February as importers rushed to beat higher U.S. tariffs and a Chinese state media report said that Beijing was considering ways to retaliate.

Trump had imposed a tariff of 10% on imports from China, and that’s scheduled to rise to 20% beginning Tuesday. He also ended the “de minimis” loophole that exempted imports worth less than $800 from tariffs.

In Hong Kong, Chinese bubble tea chain Mixue Bingcheng’s stock soared 43% following its $444 million debut on the market. The company claims to be the world’s largest food retail chain, with more than 45,000 outlets, and its jump came as the Hang Seng index rose 0.3%.

Indexes rose by even more across Europe and in Tokyo. European markets leaped after a report showed an easing of inflation in February. That should help the European Central Bank, which investors widely expect will deliver another cut to interest rates later this week.

Germany’s DAX surged 2.6%, and France’s CAC 40 jumped 1.1%. Stocks outside the United States have performed better than the S&P 500 this year, even with Trump’s promises for “America First” policies

In the bond market, the yield on the 10-year Treasury fell to 4.16% from 4.24% just before the manufacturing report’s release. It’s come down sharply since January, when it was approaching 4.80%, as worries have built about the possibility of a slowing U.S. economy.

Often, drops in Treasury yields can give a boost to stock prices because they make loans cheaper to get and give a boost to the economy. But the reason for this recent drop in yields, softer economic growth expectations, may mean that’s not the case this time, according to Morgan Stanley strategists led by Michael Wilson.

Typically, the Federal Reserve would cut interest rates if the economy needs help. But when inflation is high, or at least worries about it are, the Fed has less leeway to ease rates.

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.

3 Mar, 2025 | Admin | No Comments

Trump says 25% tariffs on Mexican and Canadian imports will start Tuesday, with ‘no room’ for delay

By ZEKE MILLER, JOSH BOAK and ROB GILLIES, Associated Press

WASHINGTON (AP) — President Donald Trump said Monday that 25% taxes on imports from Mexico and Canada would start Tuesday, sparking renewed fears of a North American trade war that already showed signs of pushing up inflation and hindering growth.

“Tomorrow — tariffs 25% on Canada and 25% on Mexico. And that’ll start,” Trump told reporters in the Roosevelt Room. “They’re going to have to have a tariff.”

Trump has said the tariffs are to force the two U.S. neighbors to step up their fight against fentanyl trafficking and stop illegal immigration. But Trump has also indicated that he wants to even the trade imbalance with both countries as well and push more factories to relocate in the United States.

His comments quickly rattled the U.S. stock market, with the S&P 500 index down 2% in Monday afternoon trading. It’s a sign of the political and economic risks that Trump feels compelled to take, given the possibility of higher inflation and the possible demise of a decades-long trade partnership with Mexico and Canada.

Yet the Trump administration remains confident that tariffs are the best choice to boost U.S. manufacturing and attract foreign investment. Commerce Secretary Howard Lutnick said Monday that the computer chipmaker TSMC had expanded its investment in the United States because of the possibility of separate 25% tariffs.

In February, Trump put a 10% tariff on imports from China. He reemphasized Monday that the rate would be doubling to 20% on Tuesday.

Trump provided a one-month delay in February as both Mexico and Canada promised concessions. But Trump said Monday that there was “no room left for Mexico or for Canada” to avoid the steep new tariffs, which were also set to tax Canadian energy products such as oil and electricity at a lower 10% rate.

“If Trump is imposing tariffs, we are ready,” said Canadian Foreign Minister Mélanie Joly. “We are ready with $155 billion worth of tariffs and we’re ready with the first tranche of tariffs, which is $30 billion.”

Joly said Canada has a very strong border plan and explained that to Trump administration officials last week. She said the diplomatic efforts are continuing. She spoke after Trump made his comments Tuesday.

Mexico President Claudia Sheinbaum went into Monday waiting to see what Trump would say.

“It’s a decision that depends on the United States government, on the United States president,” Sheinbaum said ahead of Trump’s statement. “So whatever his decision is, we will make our decisions and there is a plan, there is unity in Mexico.”

Both countries have tried to show action in response to Trump’s concerns. Mexico sent 10,000 National Guard troops to their shared border to crack down on drug trafficking and illegal immigration. Canada named a fentanyl czar, even though smuggling of the drug from Canada into the United States appears to be relatively modest.

As late as Sunday, it remained unclear what choice Trump would make on tariff rates. Lutnick told Fox News Channel’s “Sunday Morning Futures” that the decision was “fluid.”

“He’s sort of thinking about right now how exactly he wants to play it with Mexico and Canada,” Lutnick said. “And that is a fluid situation. There are going to be tariffs on Tuesday on Mexico and Canada. Exactly what they are, we’re going to leave that for the president and his team to negotiate.”

Treasury Secretary Scott Bessent said Mexico has also offered to place 20% taxes on all imports from China as part of talks with the United States.

Bessent told CBS News on Sunday that China would “eat” the cost of the tariffs, instead of passing them along to the U.S. businesses and consumers that import their products in the form of higher prices.

But companies ranging from Ford to Walmart have warned about the negative impact that tariffs could create for their businesses. Similarly, multiple analyses by the Peterson Institute for International Economics and the Yale University Budget Lab suggest that an average family could face price increases of more than $1,000.

“It’s going to have a very disruptive effect on businesses, in terms of their supply chains as well as their ability to conduct their business operations effectively,” said Eswar Prasad, an economist at Cornell University. “There are going to be inflationary impacts that are going to be disruptive impacts.”

Prasad cautioned that some of the cost increases from the tariffs would be offset by the U.S. dollar increasing in value. But a stronger dollar could also make American made goods less competitive in foreign markets, possibly making it harder for Trump to close the trade imbalance.

Trump also plans to roll out what he calls “reciprocal” tariffs on April that would match the rate charged by other countries, including any subsidies and and value added taxes charged by those countries.

The U.S. president has already announced the removal of exemptions from his 2018 tariffs on steel and aluminum, in addition to tariffs on autos, computer chips, copper and pharmaceutical drugs.

AP economics writer Christopher Rugaber contributed to this report.