11 Mar, 2025 | Admin | No Comments

Trump halts doubling of tariffs on Canadian metals, after Ontario suspends electricity price hikes

By JOSH BOAK, ROB GILLIES and MICHELLE L. PRICE, Associated Press

WASHINGTON (AP) — President Donald Trump ‘s threat Tuesday to double his planned tariffs on steel and aluminum from 25% to 50% for Canada led the provincial government of Ontario to suspend its planned surcharges on electricity sold to the United States.

As a result, White House trade adviser Peter Navarro said the U.S. president pulled back on his doubling of steel and aluminum tariffs, even as the federal government still plans to place a 25% tariff on all steel and aluminum imports starting Wednesday.

The drama delivered a win for Trump but also amplified concerns about tariffs that have roiled the stock market and stirred recession risks. Tuesday’s escalation and cooling in the ongoing trade war between the United States and Canada only compounded the rising sense of uncertainty of how Trump’s tariff hikes will affect the economies of both countries.

Trump shocked markets Tuesday morning, saying the increase of the tariffs set to take effect Wednesday was a response to the 25% price hike that Ontario put on electricity sold to the United States.

“I have instructed my Secretary of Commerce to add an ADDITIONAL 25% Tariff, to 50%, on all STEEL and ALUMINUM COMING INTO THE UNITED STATES FROM CANADA, ONE OF THE HIGHEST TARIFFING NATIONS ANYWHERE IN THE WORLD,” Trump posted on Truth Social.

Ontario Premier Doug Ford said Tuesday afternoon that U.S. Commerce Secretary Howard Lutnick called him and Ford agreed to remove the surcharge. He said he was confident that the U.S. president would also stand down on his own plans for 50% tariffs on Canadian steel and aluminum.

“He has to bounce it off the president but I’m pretty confident he will pull back,” Ford said on Trump’s steel and aluminum tariff threat. “By no means are we just going to roll over. What we are going to do is have a constructive conversation.”

After a brutal stock market selloff Monday and further jitters Tuesday, Trump faces increased pressure to show he has a solid plan to grow the economy. So far the president is doubling down on tariffs and can point to Tuesday’s drama as evidence that taxes on imports are a valuable negotiating tool, even if they can generate turmoil in the stock market.

Trump suggested Tuesday that tariffs were critical for changing the U.S. economy, regardless of stock market gyrations.

The U.S. president has given a variety of explanations for his antagonism of Canada. He has said that his separate 25% tariffs on all imports from Canada, some of which are suspended for a month, are about fentanyl smuggling and objections to Canada putting high taxes on dairy imports that penalize U.S. farmers. He also continued to call for Canada to become part of the United States, which has infuriated Canadian leaders.

“The only thing that makes sense is for Canada to become our cherished Fifty First State,” Trump posted Tuesday. “This would make all Tariffs, and everything else, totally disappear.”

Tensions between the United States and Canada

Incoming Canadian Prime Minister Mark Carney said his government will keep tariffs in place until Americans show respect and commit to free trade after Trump threatened historic financial devastation for his country.

Carney, who will be sworn in as Justin Trudeau’s replacement in coming days, said Trump’s latest tariffs are an attack on Canadian workers, families and businesses.

“My government will keep our tariffs on until the Americans show us respect and make credible, reliable commitments to free and fair trade,” Carney said in a statement.

Canadian officials are planning retaliatory tariffs in response to Trump’s specific steel and aluminum tariffs. Those are expected to be announced Wednesday.

Carney was referring to an initial $30 billion Canadian (US$21 billion) worth of retaliatory tariffs that have been applied on items like American orange juice, peanut butter, coffee, appliances, footwear, cosmetics, motorcycles and certain pulp and paper products.

Trump also has targeted Mexico with 25% tariffs because of his dissatisfaction over drug trafficking and illegal immigration, though he suspended the taxes on imports that are compliant with the 2020 USMCA trade pact for one month.

Asked if Mexico feared it could face the same 50% tariffs on steel and aluminum as Canada, President Claudia Sheinbaum, said, “No, we are respectful.”

Trump participated in a question and answer session Tuesday afternoon with the Business Roundtable, a trade association of CEOs that he wooed during the 2024 campaign with the promise of lower corporate tax rates for domestic manufacturers. But his tariffs on Canada, Mexico and China — with plans for more to possibly come on Europe, Brazil, South Korea, pharmaceutical drugs, copper, lumber and computer chips — would amount to a massive tax hike.

The stock market’s vote of no confidence over the past two weeks puts the president in a bind between his enthusiasm for taxing imports and his brand as a politician who understands business based on his own experiences in real estate, media and marketing.

“The tariffs are having a tremendously positive impact — they will have, and they are having.” Trump told the gathering of CEOs, saying the import taxes would cause more factories to relocate to the United States.

Worries about a recession are growing

Harvard University economist Larry Summers, President Bill Clinton’s treasury secretary, has put the odds of a recession at 50-50. The investment bank Goldman Sachs revised down its growth forecast for this year to 1.7% from 2.2% previously. It modestly increased its recession probability to 20% “because the White House has the option to pull back policy changes if downside risks begin to look more serious.”

Trump has tried to assure the public that his tariffs would cause a bit of a “transition” to the economy, with the taxes prodding more companies to begin the yearslong process of relocating factories to the United States to avoid the tariffs. But he set off alarms in an interview broadcast Sunday in which he didn’t rule out a possible recession.

The stock market slide continues

The promise of great things ahead did not eliminate anxiety, with the S&P 500 stock index tumbling 2.7% on Monday in an unmistakable Trump slump that has erased the market gains that greeted his victory in November 2024. The S&P 500 index fell roughly 0.8% on Tuesday, paring some of the earlier losses after Ontario backed down on electricity surcharges.

The Dow Jones Industrial Average lost 478 points, and the Nasdaq composite slipped 0.2%.

Trump has long relied on the stock market as an economic and political gauge to follow, only to look past it as he remains determined so far to impose tariffs. When he won the election last year, he proclaimed that he wanted his term to be considered to have started Nov. 6, 2024, on Election Day, rather than his Jan. 20, 2025, inauguration, so that he could be credited for post-election stock market gains.

Trump also repeatedly warned of an economic freefall if he lost the election.

“If I don’t win you will have a 1929 style depression. Enjoy it,” Trump said at an August rally in Pennsylvania.

Associated Press writer Fabiola Sanchez contributed to this report from Mexico City. Gillies reported from Toronto.

Rampell, a CNN contributor and op-ed columnist at The Washington Post, will join Ayman Mohyeldin as co-hosts of a new prime time version of ‘The Weekend’

11 Mar, 2025 | Admin | No Comments

Wall Street falls in a manic day after briefly dropping more than 10% below its record

By STAN CHOE, AP Business Writer

NEW YORK (AP) — The U.S. stock market fell further Tuesday following President Donald Trump’s latest escalation in his trade war, briefly pulling Wall Street 10% below its record set last month. And like it’s been for most of the past few weeks, the market’s slide on Tuesday was erratic and dizzying.

The S&P 500 fell 0.8%, but only after careening between a modest gain and a tumble of 1.5%. The main measure of Wall Street’s health finished 9.3% below its all-time high after flirting with the 10% threshold that professional investors call a “correction.”

Other indexes likewise swung sharply through the day. The Dow Jones Industrial Average lost 478 points, or 1.1%, and the Nasdaq composite ended up slipping 0.2%.

Such head-spinning moves are becoming routine in what’s been a scary ride for investors as Trump tries to remake the country and world through tariffs and other policies. Stocks have been heaving mostly lower on uncertainty about how much pain Trump is willing for the economy to endure in order to get what he wants.

And moves by Trump and comments by his White House on Tuesday didn’t clarify much.

Stocks began tumbling in the morning after Trump said he would double planned tariff increases on steel and aluminum coming from Canada. The president said it was a response to moves a Canadian province made after Trump began threatening tariffs on one of the United States’ most important trading partners.

Trump has acknowledged the economy could feel some “disturbance” because of the tariffs he’s pushing. Asked on Tuesday just how much pain Trump would be willing for the economy and stock market to take, White House press secretary Karoline Leavitt declined to give an exact answer. But she said earlier in the press briefing that “the president will look out for Wall Street and for Main Street.”

For his part, Trump said earlier on social media, “The only thing that makes sense is for Canada to become our cherished Fifty First State. This would make all Tariffs, and everything else, totally disappear.”

Stocks pared their losses later in the day, even briefly eliminating them altogether, after Ontario’s premier said he had agreed to remove the surcharge on electricity that had enraged Trump so much. Trump would afterward say that he would “probably” return the steel and aluminum tariffs on Canada to 25%.

After that brief perk higher, though, stocks would go on to slide again into the end of trading.

Tuesday’s swings followed more warning signals flashing about the economy as Trump’s on -and- off -again rollout of tariffs creates confusion and pessimism for U.S. households and businesses.

Such tariffs can hurt the economy directly by raising prices for U.S. consumers and gumming up global trade. But even if they end up being milder than feared, all the whipsaw moves could create so much uncertainty that U.S. companies and consumers freeze, which would sap energy from the economy.

Delta Air Lines’ stock lost 7.3% after it said it’s already seeing a change in confidence among customers, which is affecting demand for close-in bookings for its flights. That pushed the airline to roughly halve its forecast for revenue growth in the first three months of 2025, down to a range of 3% to 4% from a range of 7% to 9%.

Southwest Airlines also cut its forecast for an important underlying revenue trend, and it pointed specifically to less government travel, among other reasons, including wildfires in California and “softness in bookings and demand trends as the macro environment has weakened.”

Its stock nevertheless rallied 8.3% after the airline said it would soon begin charging some passengers to check bags, among other announcements.

Oracle dropped 3.1% after the technology giant reported profit and revenue for the latest quarter that fell short of analysts’ expectations.

Helping to keep the market in check were several Big Tech stocks, which steadied a bit after getting walloped in recent months. Elon Musk’s Tesla rose 3.8%, for example, after Trump said he would buy a Tesla in a show of support for “Elon’s ‘baby.’”

Tesla’s sales and brand have been under pressure as Musk has led efforts in Washington to cut spending by the federal government. Tesla’s stock is down 42.9% for the young year so far.

Other Big Tech superstars, which had led the market to record after record in recent years, also held a bit firmer. Nvidia added 1.7% to trim its loss for the year so far to 19%. It’s struggled as the market’s sell-off has particularly hit stocks seen as getting too expensive in Wall Street’s frenzy around artificial-intelligence technology.

Because Nvidia, Tesla and other Big Tech stocks have grown so massive in size, their movements carry much more weight on the S&P 500 and other indexes than any other company.

All told, the S&P 500 fell 42.49 points to 5,572.07. The Dow dropped 478.23 to 41,433.48, and the Nasdaq composite slipped 32.23 to 17,436.10.

In stock markets abroad, which have mostly been beating the United States so far this year, indexes fell across much of Europe and Asia.

Stocks rose 0.4% in Shanghai and were nearly unchanged in Hong Kong as China’s annual national congress wrapped up its annual session with some measures to help boost the slowing economy.

In the bond market, Treasury yields clawed back some of their tumbles in recent months. The yield on the 10-year Treasury rose to 4.28% from 4.22% late Monday. In January, it was nearing 4.80%, before it began sinking on worries about the U.S. economy.

A report released Tuesday morning showed U.S. employers were advertising 7.7 million job openings at the end of January, just as economists expected. It’s the latest signal that the U.S. job market remains relatively solid overall, for now at least, after the economy closed last year running at a healthy pace.

AP Business Writers Yuri Kageyama and Matt Ott contributed.

Donald Trump’s efforts to help Tesla could end up hurting it.

The U.S. president said Tuesday he will buy a Tesla as a show of support for CEO Elon Musk’s electric carmaker as it faces boycotts and even vandalism. But if Trump’s intention is to help reverse the frightening plunge in Tesla stock, he could have the opposite effect by turning off even more buyers.

“Tesla is becoming a political symbol of Trump and DOGE, and that is a bad thing for the brand,” said Wedbush Securities financial analyst Dan Ives. “You think it’s helping, but it’s actually hurting.”

In an overnight post on his Truth Social platform, Trump said Musk is “putting it on the line” to help the country. Trump claimed in the post that “Radical Left Lunatics” were attempting to “illegally and collusively boycott Tesla, one of the World’s great automakers, and Elon’s ’baby.”

Trump’s message came after one of the worst single day sell-offs in Tesla’s history. The stock was up in midday trading Tuesday, rising 3%.

In a message on X, Musk expressed confidence, writing that the stock “will be fine long-term.”

Tesla has been pummeled this year under competition from rival electric vehicles, particularly out of China, as well as his close association with Trump and with far right causes globally.

Shares have plummeted 45% in 2025 and on Monday tumbled more than 15% to $222.15, the lowest since late October, reflecting newfound pessimism as sales crater around the globe.

Numerous auto industry analysts have attributed Tesla’s recent sagging stock — and auto sales — to Musk’s support of Trump and other far right candidates around the world. In recent days, Tesla showrooms in the U.S. have been besieged by protesters, its vehicles vandalized on the street. Tesla owners, perhaps in a bid to avoid being targeted, have placed bumper stickers on their cars with messages like, “I bought it before Elon went nuts.”

Federal prosecutors charged a woman in connection with a string of vandalism against a Colorado Tesla dealership, which included Molotov cocktails being thrown at vehicles and the words “Nazi cars” spray painted on the building.

Musk pumped $270 million into Trump’s campaign heading into the 2024 election, appeared on stage with him and cheered Trump’s victory over Democratic candidate Kamala Harris in November. Tesla stock soared to $479 per share by mid-December, but have since lost 45% of their value.

Musk has become the face of the Trump administration’s slash-and-burn government downsizing efforts, known as the Department of Government Efficiency, or DOGE. The department has promised massive federal worker layoffs and aims to drastically reduce government spending.

Analysts have said Musk’s shift to right-wing politics doesn’t appear to sit well with potential Tesla buyers, generally perceived to be wealthy and progressive consumers.

Tesla sales are falling precipitously in California, the company’s biggest U.S. market, and the company recorded its first annual global sales decline last year. Similarly, Tesla sales plunged 45% in Europe in January, according to research firm Jato Dynamics, even as overall electric vehicle sales rose. The sales numbers were particularly bad in Germany and France.

The latest auto sales figure from China show that Tesla sales there have been nearly halved from February a year ago, although the decline is largely due increased competition from domestic EV companies.

But sales in the U.S. have fallen due to competition, and a country sharply divided about Trump.

U.S. Analysts at UBS Global Research expect deliveries to fall 5% in the first quarter and full year compared to the same periods for 2024.

“Our UBS Evidence Lab data shows low delivery times for the Model 3 and Model Y (generally within two weeks) in key markets which we believe is indicative of softer demand,” they wrote.

In addition to backing Trump, Musk has also shown support for the far-right, pro-Russian, anti-Muslim party in German y, called the British p rime minister an “evil tyrant” and called Canada — a major Tesla market —”not a real country.”

Tesla is not the only Musk-led company to run into trouble recently. His X social media platform crashed several times on Monday, which Musk claimed was a “massive” cyberattack. But like the clear-cutting he’s done with federal jobs, Musk slashed the number of employees at X and technology experts warned of increased vulnerability.

Last week, a rocket launched by Musk’s SpaceX exploded and broke apart over Florida, about two months after another of the company’s rockets failed.

11 Mar, 2025 | Admin | No Comments

NBC’s Peacock Continues Sports Strategy With Big East And Big Ten College Basketball Games

Peacock, NBC’s streaming service, will air early round games in the Big East and Big Ten men’s basketball tournaments this week.

11 Mar, 2025 | Admin | No Comments

‘With Love, Meghan’ Ratings: Netflix Show Bows To Lower Viewership Than ‘Harry & Meghan’

‘With Love, Meghan’ averages 526,000 viewers in its Netflix debut, barely a quarter of the audience who tuned in for the premiere of ‘Harry & Meghan’ in 2022.

10 Mar, 2025 | Admin | No Comments

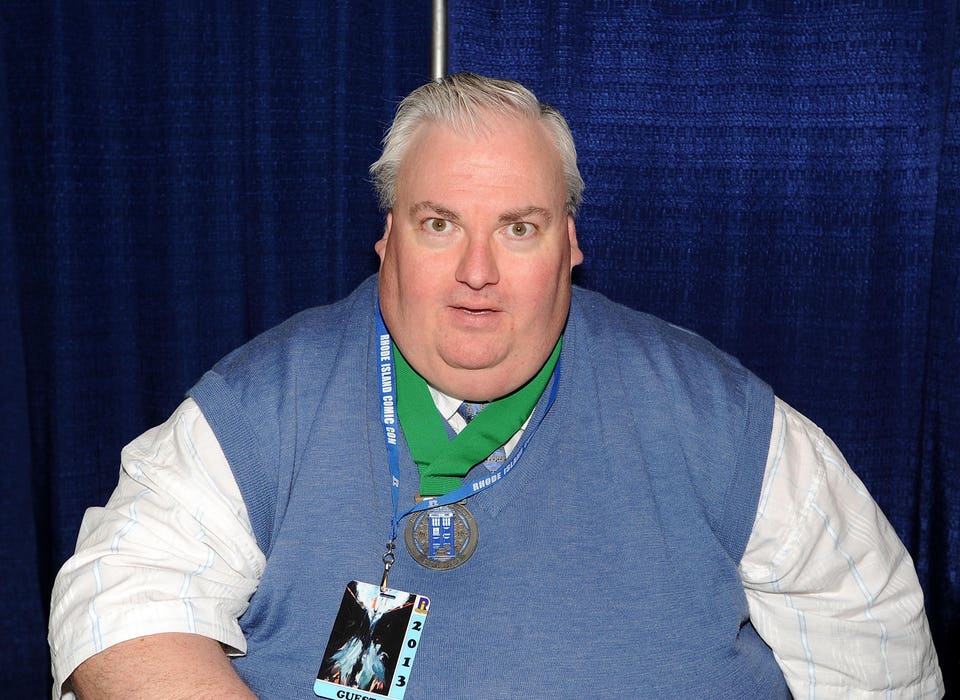

‘Harry Potter’ And ‘Doctor Who’ Actor Simon Fisher-Becker Dies At 63

Simon Fisher-Becker, who reached a career zenith in the original “Harry Potter” movie and “Doctor Who,” died on Sunday, March 9. He was 63 years old.

The 7 Roles of Every Small Business Owner and How to Manage Them written by John Jantsch read more at Duct Tape Marketing

Ever feel like running your business is a never-ending game of keeping plates spinning? I remember watching a circus performer as a kid, keeping seven or eight plates balanced on tall sticks. Just when one would start to wobble, he’d rush over to give it a quick spin, only to dash to the next one teetering on the edge of disaster.

That’s exactly what running a small business feels like, right? Unless you’ve got an army of employees, chances are you’re juggling multiple roles every day—some better than others. So, let’s break down these seven roles and talk about how you can keep those plates spinning without losing your sanity.

1. The CEO (a.k.a. The Visionary)

Someone’s got to set the direction, and spoiler alert—it’s you. But let’s be real: in small businesses, the CEO role often gets pushed to the side. You’re so busy working in the business that you forget to work on the business.

Solution? Time-blocking. Set aside a couple of hours a week—call it your “big thinking time.” No emails, no client calls, just you mapping out where you want to be a year from now. If you don’t do it, no one else will.

2. The Salesperson (a.k.a. The Rainmaker)

No one’s bringing in the revenue but you. You’re out there generating leads, following up, and closing deals. And let’s be honest, if you stop selling, everything else grinds to a halt.

Solution? Automate your follow-ups. Tools like ActiveCampaign and HubSpot can send nurture emails, move prospects through a pipeline, and remind you when it’s time to follow up personally. Set up a system once, and let it work for you.

3. The Strategist (a.k.a. The Master Planner)

Marketing without strategy is just guessing.

Solution: Follow a proven framework. Our Strategy First framework provides a repeatable process to ensure marketing efforts are structured and scalable.

What is Strategy First? Strategy First is a structured marketing approach that helps businesses attract the right clients, differentiate themselves, and start charging a premium. It includes a full audit of your online presence, competitive landscape analysis, ideal client persona development, and a customer journey map using our proprietary Marketing Hourglass methodology. This process, completed in 30-45 days with three 1-on-1 meetings, delivers a clear marketing roadmap that businesses can implement themselves or with continued support from a Fractional CMO. Learn more about Strategy First process.

4. The Project Manager (a.k.a. The Organizer of Chaos)

Once you’ve got clients and a strategy, now you’ve got to get the work done. Campaigns, vendors, deliverables—it all needs to be managed.

Solution? Project management tools like Asana, Monday (what we use here at DTM), or ClickUp. These keep everything organized and show clients the progress you’re making without a million email check-ins.

5. The Client Manager (a.k.a. The Relationship Keeper)

If you want long-term clients (and you do), you’ve got to nurture those relationships. Regular check-ins, reports, and proving your value—week in, week out.

Solution? AI-powered reporting. Tools like SEMrush and Google Analytics spit out tons of data, but AI can help translate that into meaningful insights for your clients. Use it to show why what you’re doing matters.

6. The Marketer (a.k.a. The One Who Always Puts Clients First)

Raise your hand if you’ve ever put your own marketing on the back burner because client work comes first. Yeah, we’ve all been there.

Solution? Treat your business like a client. Assign yourself a project manager, use AI tools to repurpose content (e.g., take a blog post and turn it into LinkedIn snippets), and schedule social posts in bulk. Your future self will thank you.

7. The Accountant (a.k.a. The One Who Hates This Part)

Invoicing, bookkeeping, taxes—it’s got to get done, but that doesn’t mean you have to do it.

Solution? Outsource it. If you’re spending hours wrestling with numbers, you’re losing time you could be using to grow your business. Hire a bookkeeper and let them handle it.

How to Escape the Chaos

So, how do you stop feeling like a circus act?

- Prioritize the most important roles. Sales, strategy, and client management should top the list.

- Automate what you can. Email sequences, project management, reporting—there’s a tool for everything.

- Delegate and outsource. Hire a VA, a bookkeeper, or a marketing agency. Free up your time for the work that actually moves the needle.

At the end of the day, you don’t have to keep spinning plates forever. Build systems, get support, and create a business that works for you—not one that runs you into the ground.

Need help creating a system that works? Check out our Strategy First program at Duct Tape Marketing. We’ve built a repeatable framework that helps agencies and consultants scale without the chaos.

CBS has announced that “The Neighborhood” will conclude after its eighth season in 2005-26.

10 Mar, 2025 | Admin | No Comments

Stocks’ sell-off worsens as Wall Street wonders how much pain Trump will accept for the economy

By STAN CHOE, AP Business Writer

NEW YORK (AP) — The U.S. stock market’s sell-off cut deeper on Monday as Wall Street questioned how much pain President Donald Trump will let the economy endure through tariffs and other policies in order to get what he wants.

The S&P 500 dropped 2.7% to drag it close to 9% below its all-time high, which was set just last month. At one point, the S&P 500 was down 3.6% and on track for its worst day since 2022. That’s when the highest inflation in generations was shredding budgets and raising worries about a possible recession that ultimately never came.

The Dow Jones Industrial Average dropped 890 points, or 2.1%, after paring an earlier loss of more than 1,100, while the Nasdaq composite skidded by 4%.

It was the worst day yet in a scary stretch where the S&P 500 has swung more than 1%, up or down, seven times in eight days because of Trump’s on -and- off -again tariffs. The worry is that the whipsaw moves will either hurt the economy directly or create enough uncertainty to drive U.S. companies and consumers into an economy-freezing paralysis.

The economy has already given some signals of weakening, mostly through surveys showing increased pessimism. And a widely followed collection of real-time indicators compiled by the Federal Reserve Bank of Atlanta suggests the U.S. economy may already be shrinking.

Asked over the weekend whether he was expecting a recession in 2025, Trump told Fox News Channel: “I hate to predict things like that. There is a period of transition because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing.” He then added, “It takes a little time. It takes a little time.”

Trump says he wants to bring manufacturing jobs back to the United States, among other reasons he’s given for tariffs. His Treasury secretary, Scott Bessent, has also said the economy may go through a “detox” period as it weans off an addiction to spending by the government. The White House is trying to limit federal spending, while also cutting the federal workforce and increasing deportations, which could hinder the job market.

The U.S. job market is still showing stable hiring at the moment, to be sure, and the economy ended last year running at a solid rate. But economists are marking down their forecasts for how the economy will perform this year.

At Goldman Sachs, for example, David Mericle cut his estimate for U.S. economic growth to 1.7% from 2.2% for the end of 2025 over the year before, largely because tariffs look like they’ll be bigger than he was previously forecasting.

He sees a one-in-five chance of a recession over the next year, raising it only slightly because “the White House has the option to pull back policy changes” if the risks to the economy “begin to look more serious.”

“There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs,” according to Chris Larkin, managing director, trading and investing, at E-Trade from Morgan Stanley.

In response to the market sell-off, White House spokesman Kush Desai noted that a number of companies have responded to Trump’s “America First” economic agenda with “trillions in investment commitments that will create thousands of jobs.”

Trump met on Monday with tech industry CEOs, but the event was closed to the news media. He remained silent about the sell-off through the day.

The worries hitting Wall Street have so far been hurting some of its biggest stars the most. Big Tech stocks and companies that rode the artificial-intelligence frenzy in recent years have slumped sharply.

Nvidia fell another 5.1% Monday to bring its loss for the year so far to more than 20%. It’s a steep drop-off from its nearly 820% surge over 2023 and 2024.

Elon Musk’s Tesla fell 15.4% to deepen its loss for 2025 to 45%. After getting an initial post-election bump on hopes that Musk’s close relationship with Trump would help the electric-vehicle company, the stock has slumped on worries that its brand has become intertwined with Musk. Protests against the U.S. government’s efforts to cull its workforce and other moves have targeted Tesla dealerships, for example.

Stocks of companies that depend on U.S. households feeling good enough about their finances to spend also fell sharply. Cruise-ship operator Carnival dropped 7.6%, and United Airlines lost 6.3%.

It’s not just stocks struggling. Investors are sending prices lower for all kinds of investments whose momentum had earlier seemed nearly impossible to stop at times, such as bitcoin. The cryptocurrency’s value has dropped below $80,000 from more than $106,000 in December.

Instead, investors have bid up U.S. Treasury bonds as they look for things whose prices can hold up better when the economy is under pressure. That has sent prices for Treasurys sharply higher, which in turn has sent down their yields.

The yield on the 10-year Treasury tumbled again to 4.22% from 4.32% late Friday. It’s been dropping since January, when it was approaching 4.80%, as worries about the economy have grown. That’s a major move for the bond market.

All the uncertainty, though, hasn’t shut down dealmaking on Wall Street. Redfin’s stock jumped 67.9% after Rocket said it would buy the digital real estate brokerage in an all-stock deal valuing it at $1.75 billion. Rocket’s stock sank 15.3%.

ServiceNow fell 7.9% after the AI platform company said it was buying AI-assistant maker Moveworks for $2.85 billion in cash and stock.

All told, the S&P 500 fell 155.64 points to 5,614.56. The Dow Jones Industrial Average dropped 890.01 to 41,911.71, and the Nasdaq composite sank 727.90 to 17,468.32.

In stock markets abroad, European indexes largely fell following a mixed session in Asia.

Indexes fell 1.8% in Hong Kong and 0.2% in Shanghai after China said consumer prices fell in February for the first time in 13 months. It’s the latest signal of weakness for the world’s second-largest economy, as persistent weak demand was compounded by the early timing of the Lunar New Year holiday.

AP Business Writers Matt Ott, Elaine Kurtenbach and Josh Boak contributed.